Historically low inventory is one of the major issues affecting the Outer Banks real estate market. High demand is another.

The Stats

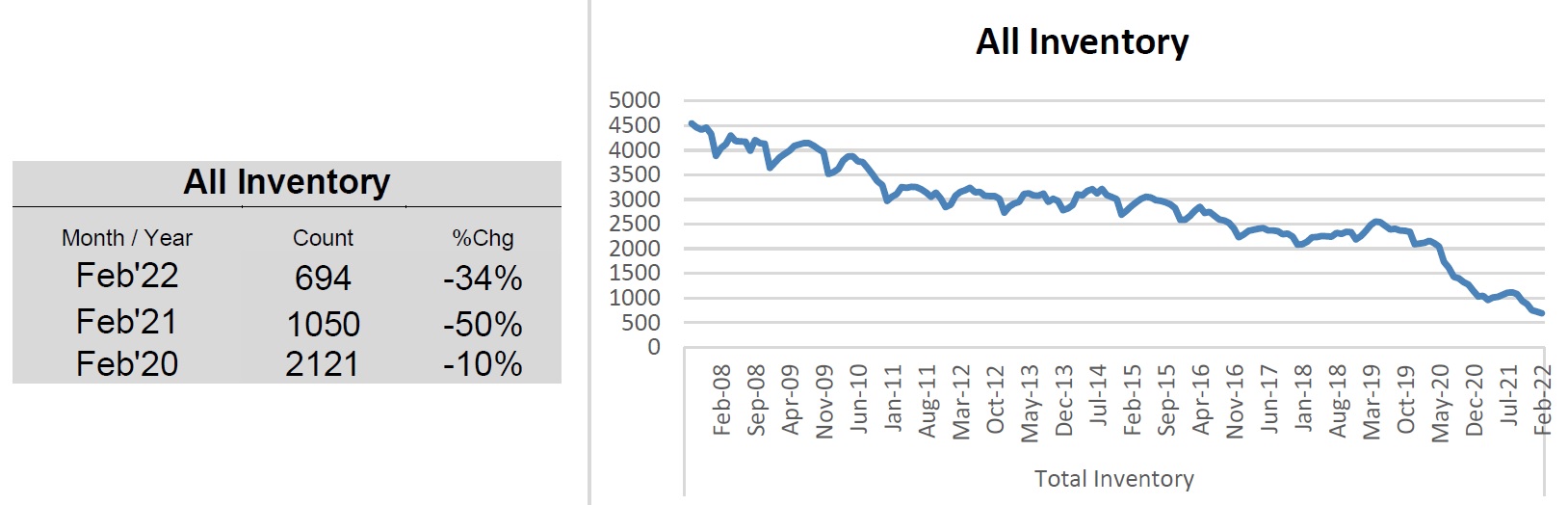

The February Statistical Update from the Outer Banks Association of Realtors, just like last month, has the lack of inventory as the top bullet point at the beginning of their report. Total inventory is down 34%, residential inventory down by 36%, lots/land down 34%, commercial down 30%. Compared to 2020 residential inventory is off 80%, lots and land down 49%.

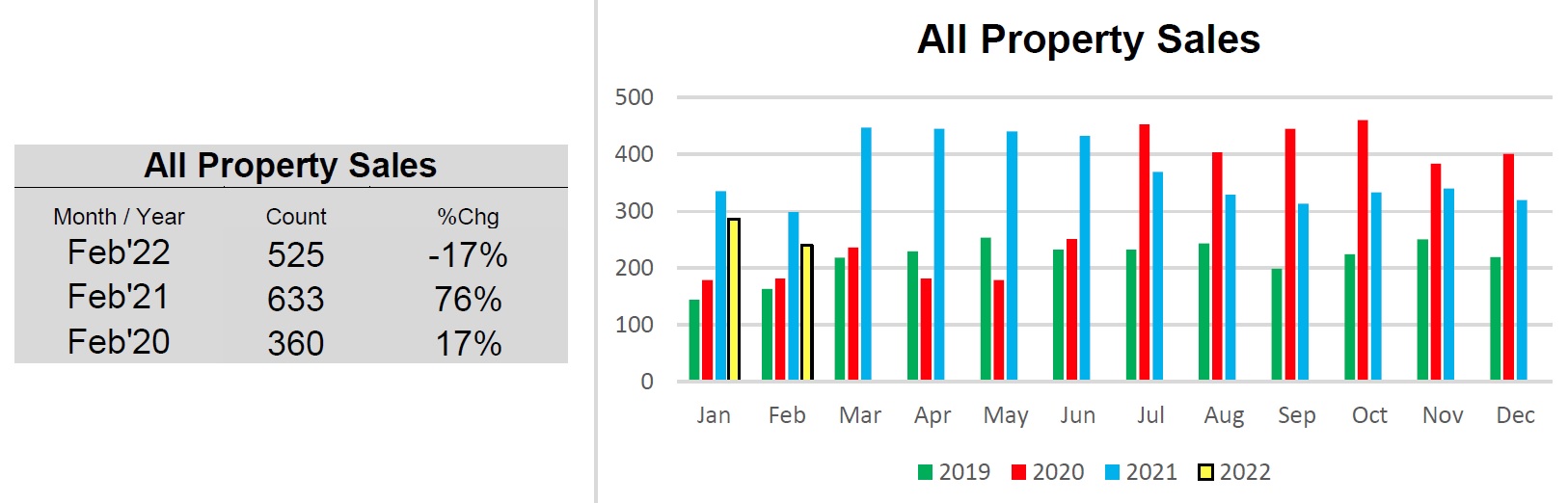

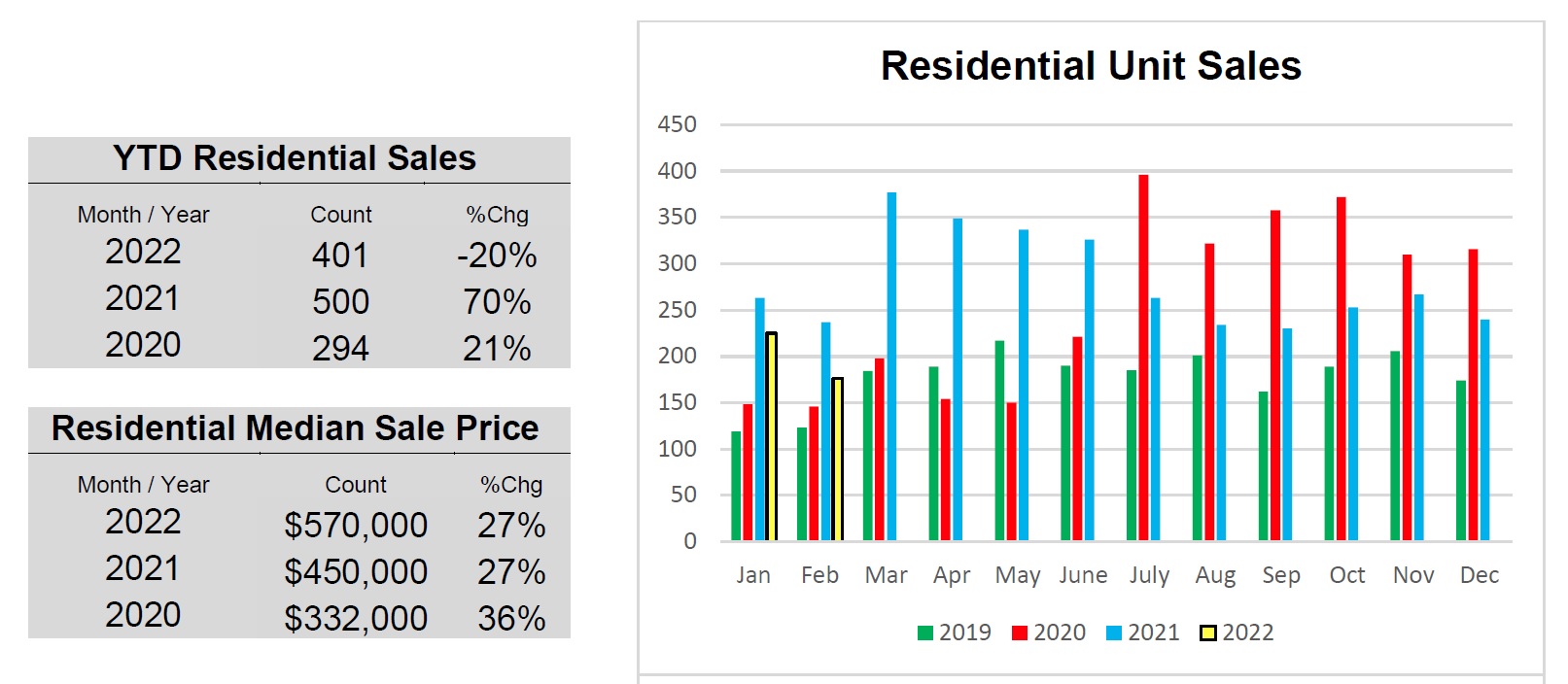

Total sales are down 17% with residential off 20%, lots/land down 7% However, both are still way ahead compared to 2020 with residential up 36% and lot/land up 85%.

While unit sales are down, sales volume is up! Residential is up 14%, lots/land up 11%. This is a result of the sales price increases we have had over the past few years. Nearly all of the individual geographic areas show an increase over last year. The total market’s median residential sales price was up 27% to $570,000, lot/land up 14% to $110,242. So, for example, even with residential unit sales down nearly 100 units, 20%, residential sales volume was up 14%.

High demand for the meager amount of inventory is reducing the days-on-market for the year so far to 43 days, down from 82 days last year. The median days on market for the same period last year was 26, down to 17 in 2022.

Affordable Homes

On the day OBAR retrieved their data for the report they noted “Interesting, there are only 78 residential listings that are priced at less than $400K and only 35 of these properties are on the Outer Banks between Corolla and Hatteras.” More interesting to me is that only 18 of those 35 have been listed this year. Take out the co-ownerships, where 5 plus weeks are sold, not the property itself, the number of available properties drops to 26 total, 13 listed in 2022.

Market Pace and Demand

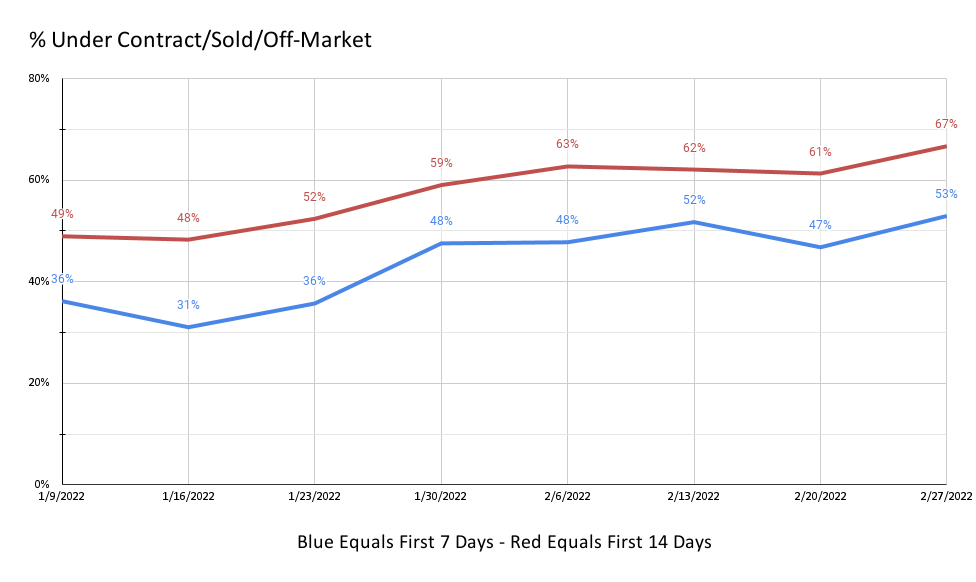

In my weekly reports, I track how fast the market is moving. For 2022 an average of 44% of new listings are under contract/sold/off the market in the first 7 days. 57% are under contract/sold/off the market in 14 days. For the four-week period beginning January 31st and ending February 27th 50% of new listings are under contract sold or off the market in the first 7 days, 63% in the first 14 days.

The available properties are moving fast, but to compound the issue, the number of new listings coming to market is down 13% year-to-date. Fewer available properties selling faster creates a real headache for agents working with buyers! 75% of all of the new listings in 2022 are already off the market.

Moose’s Take

If you have been waiting for the right time to sell this is it! With limited inventory, your home will be considered by many more buyers than in a steadier real estate market. Your home will stand out and face less competition. For buyers, we absolutely have to strategize to get you the property you want. This seller’s market requires different tactics in order to get your offer accepted. Let’s get together now to work on your individual plan for success.

Individual Area Stats

Here are the February stats for the individual areas:

- Corolla – Sales are down 35%, median sales price up 14% to $827,500. Average days on market 44, compared to 179 in 2021.

- Duck – Sales up 14%, median sales price up 35% to $879,000. Average days on market 42 compared to 33 in 2021. But without the co-ownerships, where 5 plus weeks are sold, not the property itself, sales were up 26%, median sales price up 32% to $899,000. Average days on market 29 compared to 23 in 2021.

- Southern Shores – Sales up 19%, median sales price up 25% to $816,500. Average days on market 43 compared to 67 in 2021.

- Kitty Hawk – Sales are down 11%, median sales price also down 11% to $$444,000. Average days on market 20 compared to 26 in 2021.

- Colington – Sales down 39%, median sales price up 25% to $449,000. Average days on market 23 compared to 33 in 2021.

- Kill Devil Hills – Sales are flat, median sales price up 6% to $436,000. Average days on market 31 compared to 41 in 2021.

- Nags Head – Sales down 29%, median sales price up 27% to $792,500. Average days on market 42 compared to 92 in 2021.

- All Hatteras – Sales down 23%, median sales price down 1% to $519,000. Average days on market 66 compared to 189 in 2021.

- Roanoke Island – Sales down 13%, median sales price up 11% to $475,000. Average days on market 42 compared to 66 in 2021.

- Currituck Mainland – Sales down 28%, median sales price up 7% to $355,000. Average days on market 24 compared to 40 in 2021.

- Ocracoke – Sales are flat, median sales price up 24% to $535,000. Average days on market 99 compared to 66 in 2021.

Information in this article is based on information from the Outer Banks Association of REALTORS® MLS for the period January 1, 2020, through March 8th, 2022.

Mike is a long-time “Outer Banker”, both as a vacationer and a full-time resident. You may also know him as “Moose”, his nickname since he was 15 years old, and his on-air radio name for decades in Raleigh, Greensboro/Winston-Salem, Norfolk, and formerly on Beach 104 every morning on the “Moose & Jody Show” for over 14 years. Michael has built successful businesses on the Outer Banks. He is active in the community as well as a founding board member and Vice President of “Outer Banks Forever”, Past President of “The First Flight Society”, a founding member of “The Outer Banks Bicycle & Pedestrian Coalition”, and Past President and current member of “First Flight Rotary. Moose shares your love of the Outer Banks and understands the uniqueness of the area. Learn more at mooseobx.com