The March real estate market stats are out. Sales and inventory are the two buzzwords. Let’s dive in! On April 7th the Outer Banks Association of Realtors released the March MLS Statistical Report. There are two buzzwords in the report; one is way up, the other way down.

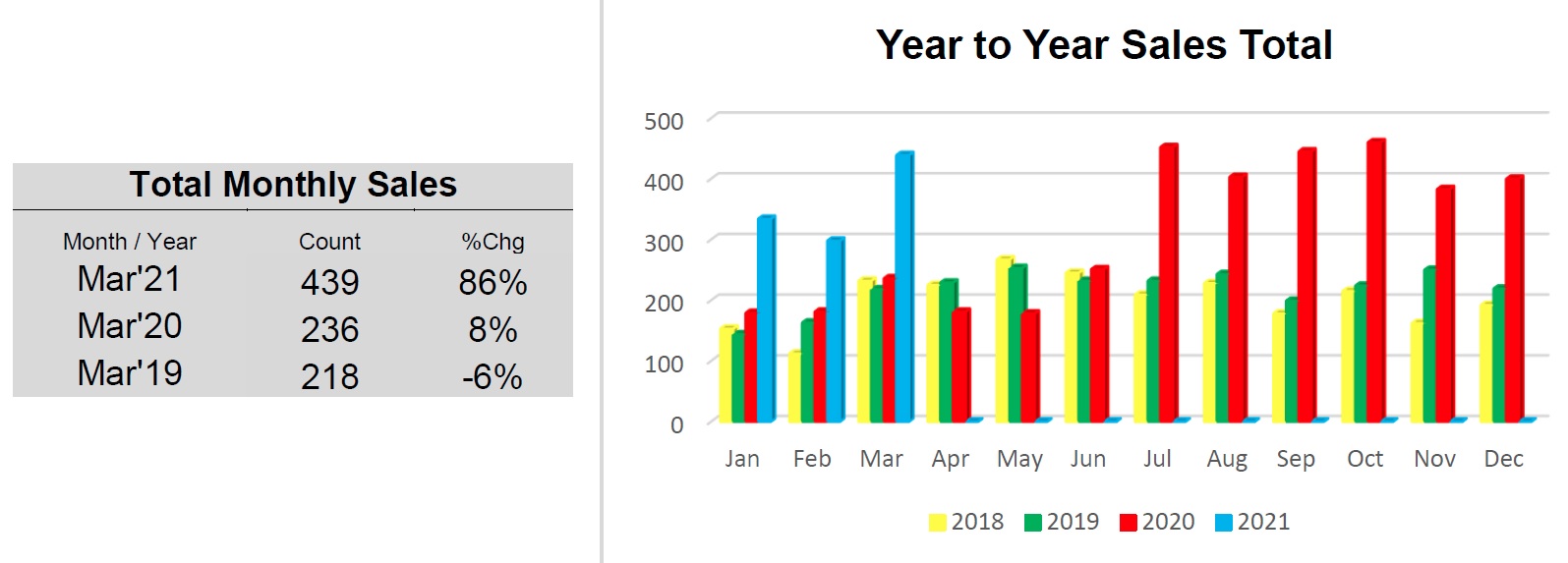

Buzzword one is sales, and they are way up. Total monthly sales are up 86%, yearly sales up 80% Residential sales are up 87%, lot/land sales up 74%.

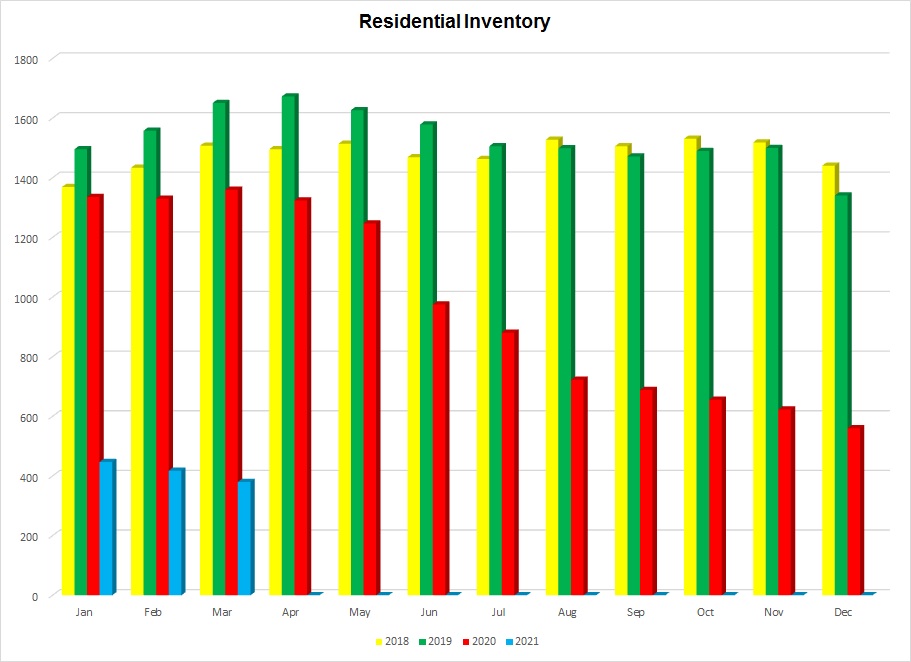

Buzzword two is inventory, and it is way down. Total inventory is down 55% compared to 50% for the previous month. Lot/land inventory is down 26%, residential inventory is down 72%.

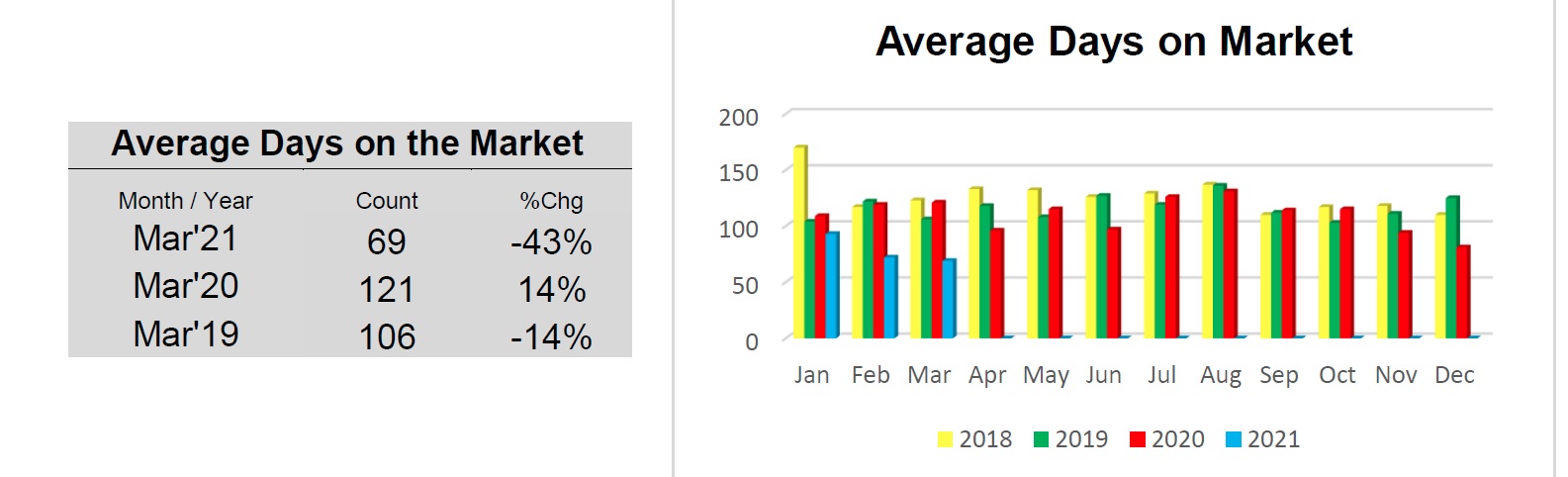

“Days on market” is down 44% to 69 days. “Median days on market”, which I think is a better indicator of how quickly things are moving, was 16 days for March. Prime properties priced correctly in all price ranges are still going under contract quickly; 46 were under contract in one day or less.

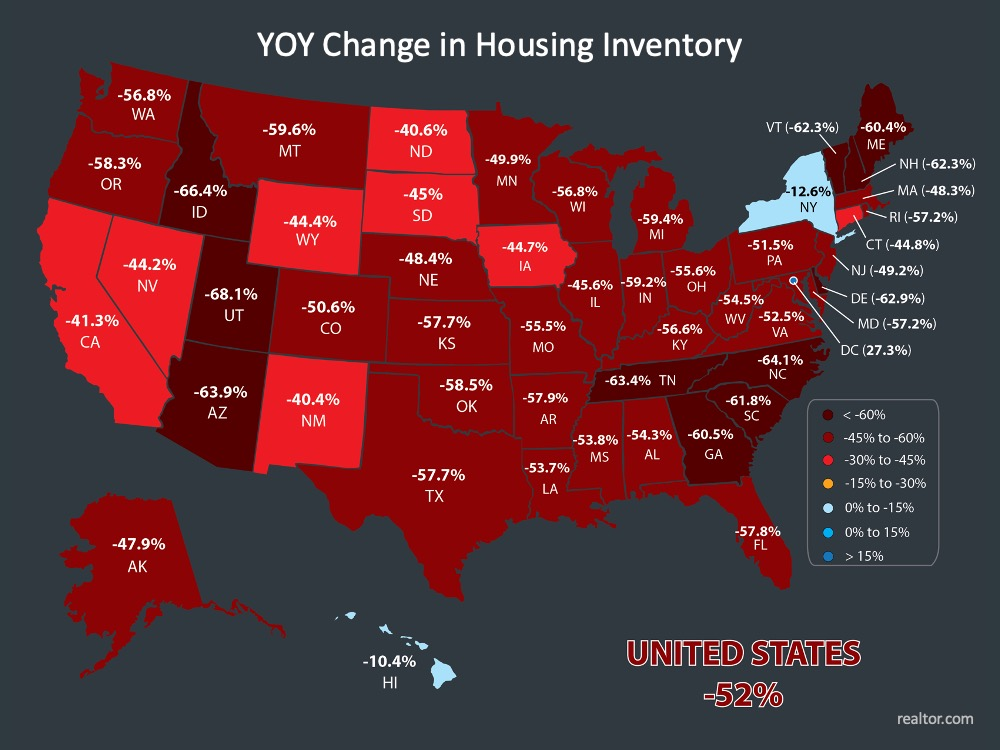

The buzzword inventory remains a problem in most of the country, now off 52%. In North Carolina inventory is down 64.1%, Virginia is off 52.5%. Utah is the state with the biggest drop in housing inventory at 68.1% So you can see The Outer Banks at a 72% decrease presents real issues for those wanting to buy, and the REALTORS trying to assist them.

A few tips for buyers are:

- Pre-qualification documents are essential. Some sellers will require them before allowing you to see the home. You’ll need a “pre-qual” letter if you are borrowing, proof of funds if you are offering cash.

- Consider the listing price a starting point. While this may not be true for every property many are priced to receive multiple offers in order to drive up the price.

- Look for properties that are priced 10% to 20% below what you have budgeted for your purchase. This gives you room when you get into a multiple-offer situation. According to the National Association of Realtors, the national average for the number of offers on a closed sale is 4.1.

- Make your offer as clean as possible. Reduce or eliminate contingencies. You may have to use one or two to achieve your personal goal. Just understand you may be going up against an offer that doesn’t have any. The seller may be motivated to accept the offer they feel has the best chance of closing, versus the offer with the highest price.

- Due-diligence fees are becoming more common. Be prepared to consider them to make your offer more enticing. However, understand how these fees work and what can happen if you are unable to close the transaction. We will need to discuss this thoroughly before making the offer to ensure you have a full understanding of the due diligence process.

For sellers, we will work together to set your listing price to ensure you are not leaving money on the table, and the property is getting the most visibility with buyers. I’ll have plenty of research to help us make the best decision. If you decide upon a higher price than what my research indicates, and the home is on the market for more days than the updated days on market figures we’ll need to circle back to what the research indicates is the best listing price. In a super seller’s market like this, the play that is working to get the highest price is setting the listing price at or just a little below the market value to generate multiple offers. Buyers will skip over properties priced too high resulting in reduced visibility for your listing.

Now a look at the stats for the individual areas. For the month of March;

- Corolla – Sales up 210% – Median Sales Price up 30% to $727,500.

- Duck – Sales up 183% – Median Sales Price up 17% to $609,200.

- Southern Shores – Sales up 33% – Median Sales Price up 28% to $655,250.

- Kitty Hawk – Sales down 25% – Median Sales Price up 22% to $480,000.

- Colington – Sales up 67% – Median Sales Price up 21% to $361,000.

- Kill Devil Hills – Sales up 112% – Median Sales Price up 12% to $370,000.

- Nags Head – Sales up 48% – Median Sales Price up 13% to $540,000.

- All Hatteras – Sales up 88% – Median Sales Price up 34% to $502,500.

- Roanoke Island – Sales up 18% – Median Sales Price up 51% to $537,500.

- Currituck Mainland – Sales down 15%, Median Sales Price up 15% to $319,000

- Ocracoke – Sales up 400% (from 1 unit to 5) – Median Sales Price up 34% to $475,000.

Information in this article is based on information from the Outer Banks Association of REALTORS® MLS for the period January 1, 2020, through April 7th, 2021.

Mike is a long-time “Outer Banker”, both as a vacationer and a full-time resident. You may also know him as “Moose”, his nickname since he was 15 years old, and his on-air radio name for decades in Raleigh, Greensboro/Winston-Salem, Norfolk, and formerly on Beach 104 every morning on the “Moose & Jody Show” for over 14 years. Michael has built successful businesses on the Outer Banks. He is active in the community as well as a founding board member of “Outer Banks Forever”, Past President of “The First Flight Society”, a founding member of “The Outer Banks Bicycle & Pedestrian Coalition”, and Past President and current member of “First Flight Rotary. Moose shares your love of the Outer Banks and understands the uniqueness of the area. Learn more at mooseobx.com