What’s Going To Happen with Home Prices This Year?

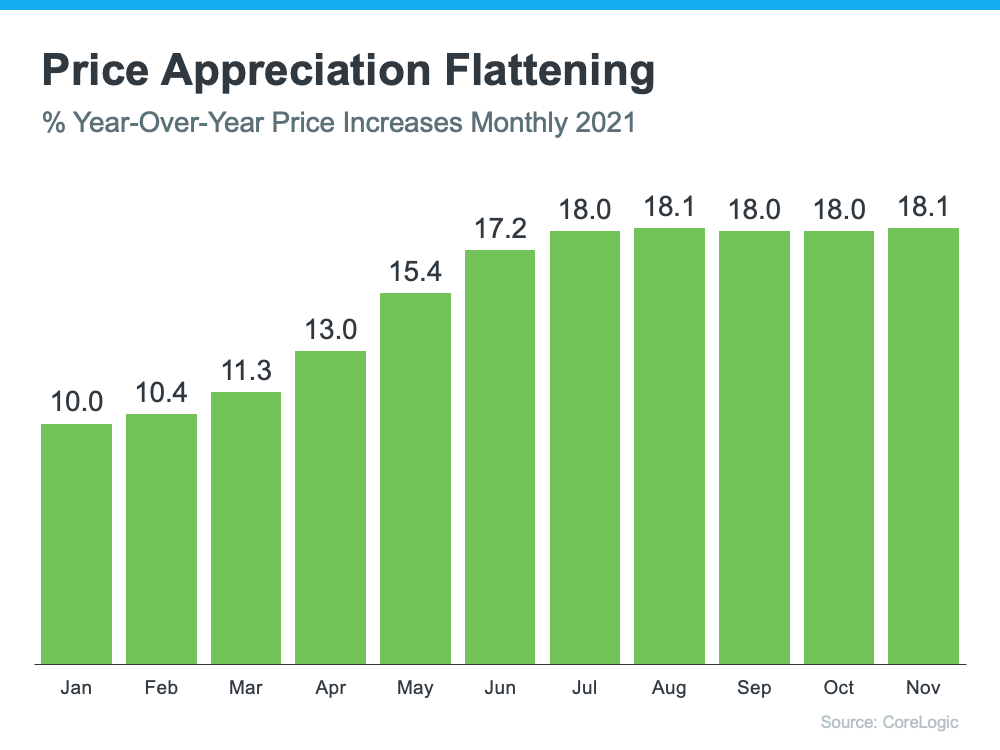

After almost two years of double-digit increases nationally, many experts thought home price appreciation would decelerate or happen at a slower pace in the last quarter of 2021. However, the latest Home Price Insights Report from CoreLogic indicates while prices may have plateaued, appreciation has definitely not slowed. The following graph shows year-over-year appreciation throughout 2021. December data had not yet been released when this was written.

As the graph shows, appreciation nationally has remained steady at around 18% over the last five months.

In addition, the latest S&P Case-Shiller Price Index and the FHFA Price Index show a slight deceleration from the same time last year – it’s just not at the level that was expected. However, they also both indicate there’s continued strong price growth throughout the country. FHFA reports all nine regions of the country still experienced double-digit appreciation. The Case-Shiller 20-City Index reveals all 20 metros had double-digit appreciation.

On The OBX

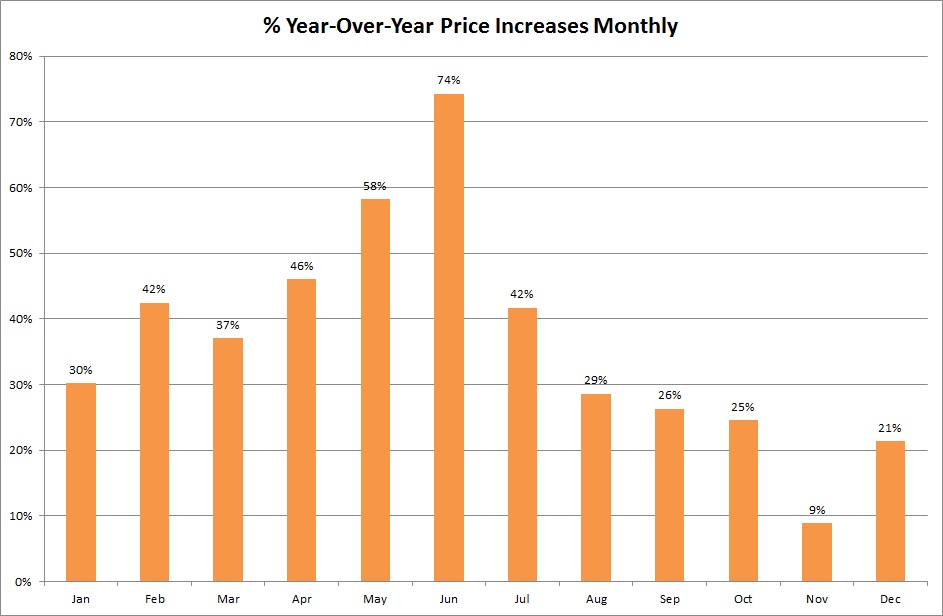

For the Outer Banks, a similar graph looks very different.

2020 versus 2021 Average Sales Price Percentage Increase. OBAR MLS

Since we are dealing with a much smaller universe you might expect more dramatic fluctuations. But this graph seems to represent what agents said they were dealing with through 2021. Especially those spring percentages as the market was rife with buyers willing to pay over asking price to get the property they wanted. For the year the average increase was 35%.

Looking ahead it is likely that appreciation will continue to flatten out. But much like the rest of the country, there just isn’t anything on the horizon that would force values down dramatically. And just like in the spring, there are still homes that are selling substantially over asking price.

Why Haven’t We Seen the Deeper Deceleration Many Expected?

Experts had projected the supply of housing inventory would increase in the last half of 2021 and buyer demand would decrease, as it historically does later in the year. Since all pricing is subject to supply and demand, it seemed that appreciation would wane under those conditions.

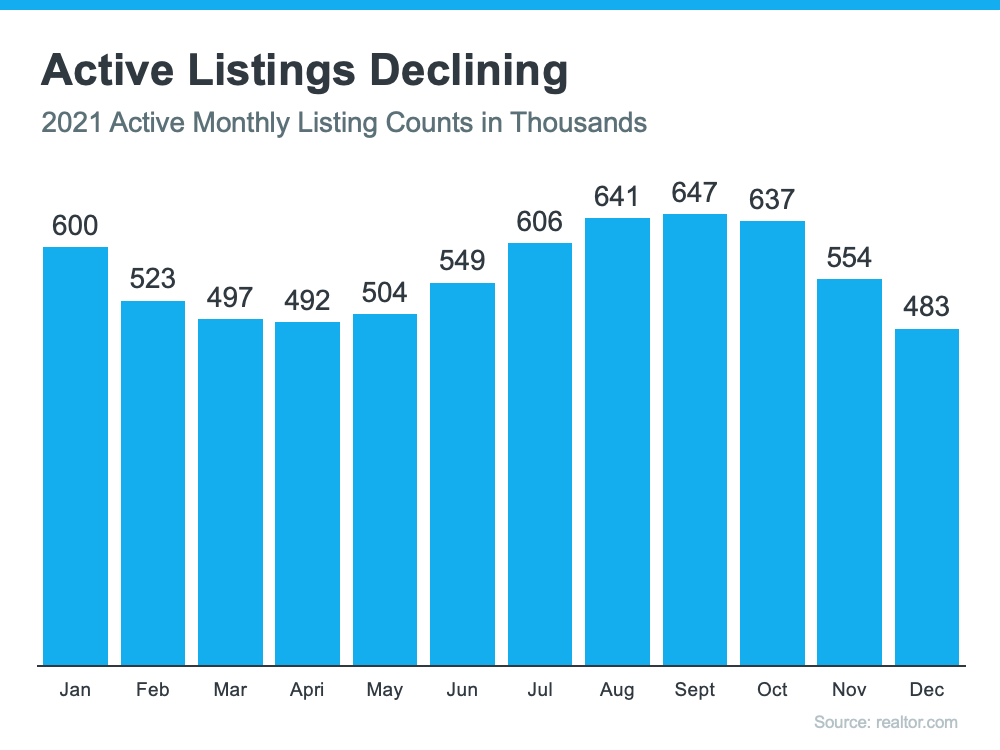

Buyer demand, however, did not slow as much as expected on a national level, and the number of listings available for sale dropped instead of improved. The graph below uses data from realtor.com to show the number of available listings for sale each month, including the decline in listings at the end of the year.

Here are three reasons why nationally the number of active listings didn’t increase as expected:

1. There hasn’t been a surge of foreclosures as the forbearance program comes to an end.

2. New construction slowed considerably because of supply chain challenges.

3. Many believed more sellers would put their houses on the market once the concerns about the pandemic began to ease. However, those concerns have not yet disappeared. A recent article published by com explains:

“Before the omicron variant of COVID-19 appeared on the scene, the 2021 housing market was rebounding healthily from previous waves of the pandemic and turned downright bullish as the end of the year approached. . . . And then the new omicron strain hit in November, followed by a December dip in new listings. Was this sudden drop due to omicron, or just the typical holiday season lull?”

No one knows for sure, but it does seem possible.

Different For The Outer Banks?

Again, the Outer Banks is a bit different. New listings here have actually ticked up just a bit each of the last four years. But looking back to 2010 there hasn’t been a great amount of fluctuation or increase. Annually, the number of new listings hovered around 3,000 a year until 2016. Fast forward to 2021 and you’ll see new listings haven’t dramatically increased. But the number of residential sales certainly has. Our market has more demand annually on about the same number of listings going on the market each year.

Listings Versus Sales 2010 – 2021. OBAR MLS

Moose’s Take

Home price appreciation might slow (or decelerate) in 2022. However, based on supply and demand, you shouldn’t expect the deceleration to be swift or deep.

If you are planning to sell in 2022 let’s talk now to develop the right strategy to get the most for your property. You may want to consider selling sooner rather than waiting. If you are buying let’s discuss the strategies that can help you find the home you want. My contact info is all over mooseobx.com!

Some of the information in this article is based on information from the Outer Banks Association of REALTORS® MLS for the period January 1, 2010, through January 19th, 2022.