The new year began with lower sales, yet continued high demand for homes, combined with the available inventory at historic lows.

The Stats

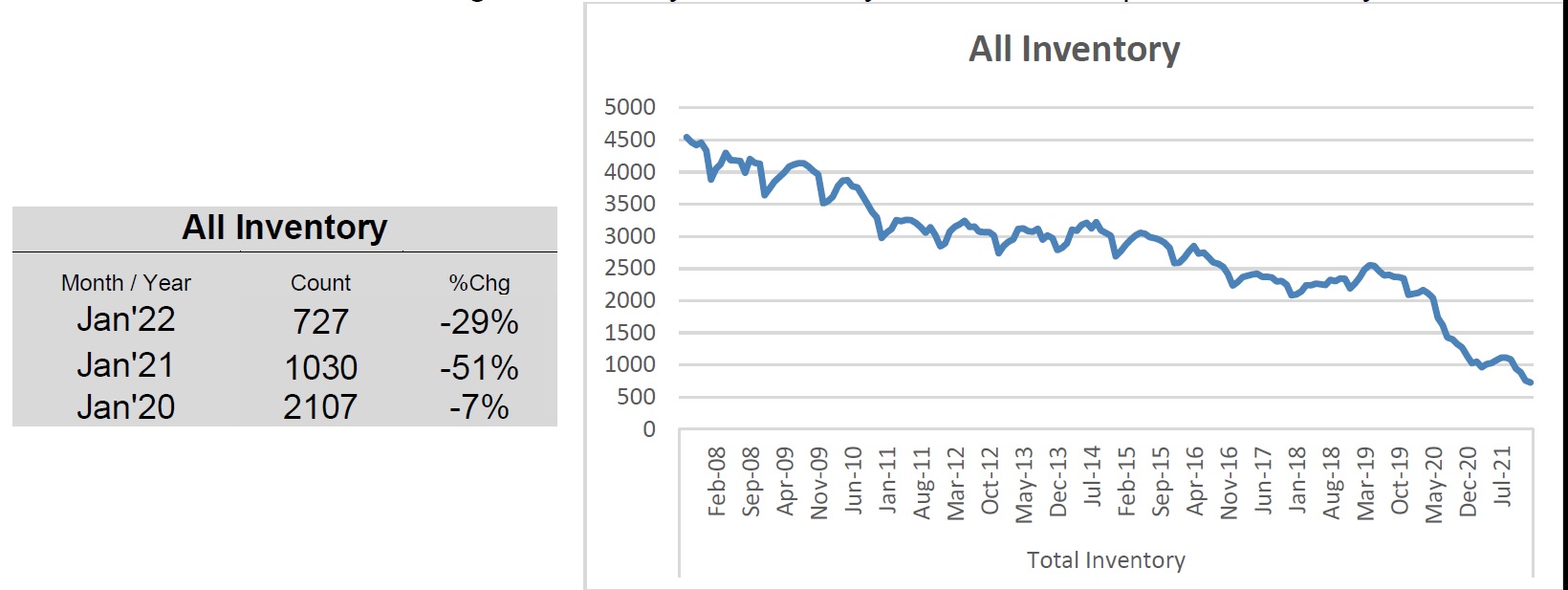

The January Statistical Update from the Outer Banks Association of Realtors highlights the inventory woes at the beginning of the report noting that total inventory is down 29% from last year, residential inventory by 37%, and lots/land down 25%. I’ll spotlight it a bit more by comparing it to 2020, residential down 79%, lots/land down 36%.

OBAR also reports the number of properties of all types under contract is down 13%. On the day this report was written (Feb. 8th) that number was 643. Last January it was at 766, and the average for 2021 was 778. It was as high as 989 in August of 2020!

But from January of 2013 through December of 2019 the under contract high mark in the data is 475. It reached that mark in April of 2014, April of 2015, and got to 473 in April of 2017. 425 to 450 units under contract was considered a “hot” market prior to 2020.

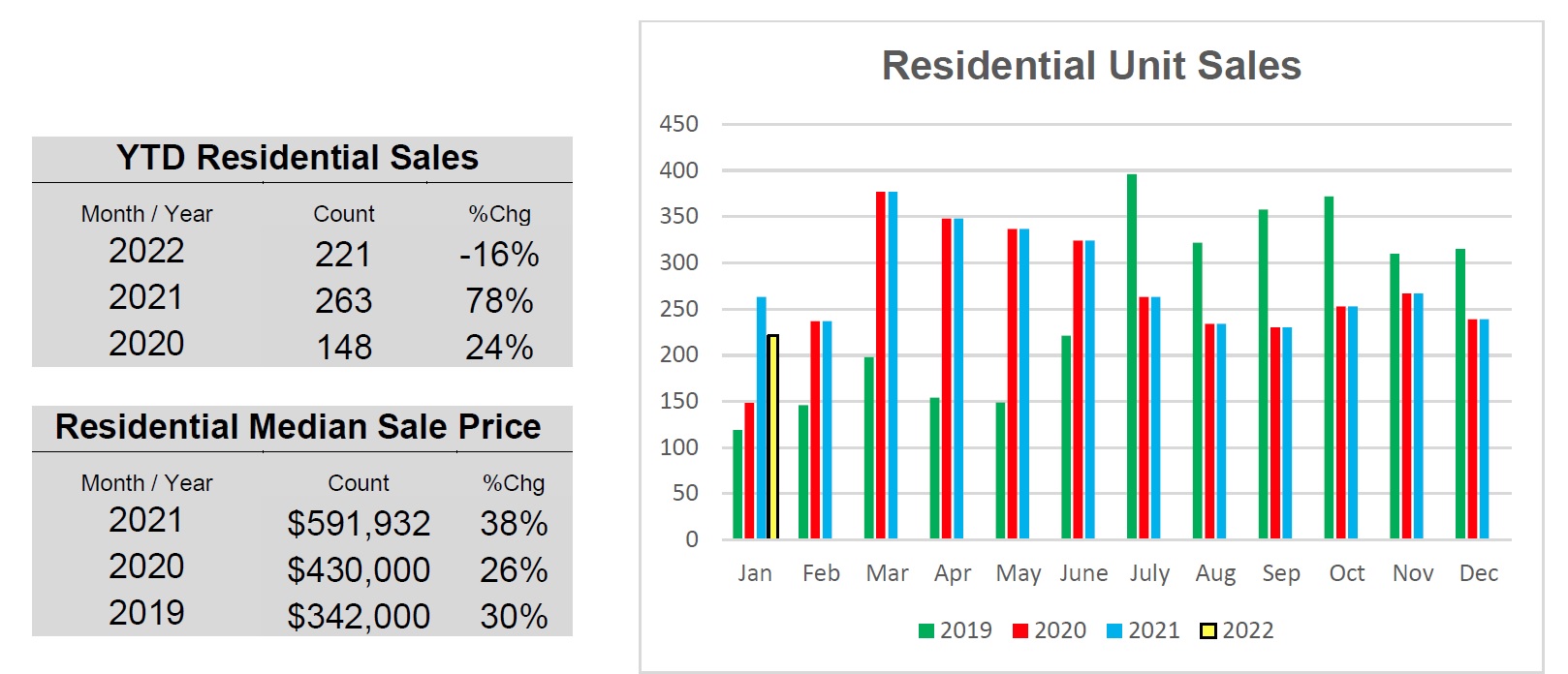

Residential unit sales are off 16% compared to January of last year, and lot/land sales are off 22%. However, both are still way ahead compared to 2020 with residential up 49% and lot/land up 85%.

Demand and Inventory

Looking at the numbers above you could conclude that residential sales wouldn’t be off 16% if inventory weren’t off 37%. Demand is still quite high for our meager inventory. So far in 2022 an average of 38% of new listings are under contract/sold/off the market in the first 7 days. 49% are under contract/sold/off the market in 14 days.

For the week ending January 30th, out of 60 new listings 31, or 52%, were under contract/sold/off the market within the first seven days, 35, or 58%, in the first 14 days, so far. We aren’t 14 days out yet.

Also, the average and median sales price continue to increase with the median sales price up 38% to $591,932. And while unit sales are off 16%, the total volume is up 16%, $22,721,352 over last year to $161,740,707. The demand is there, the inventory isn’t.

Yet another indicator of high demand is the average “days on market” figure, for the year dropping from 92 days in 2021 to 41 days now. The median days on market for January of 2021 was 21, down to 18 in 2022.

Home Prices

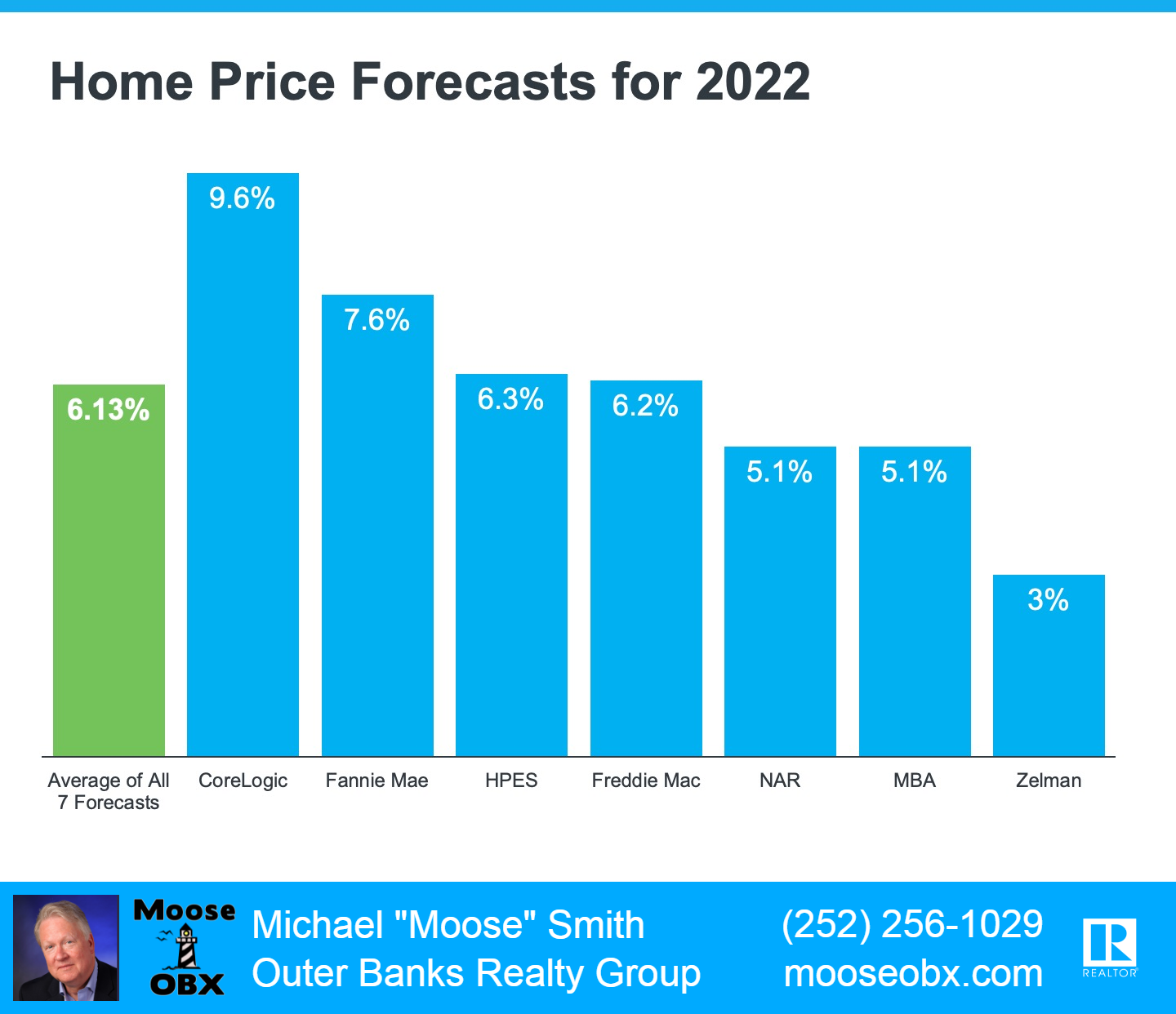

If you are wondering about home price forecasts for 2022, I did an article on that subject a couple of weeks ago. But in short, they are expected to continue to rise nationwide, but not as much of an increase when compared to the last two years. The graph below shows what the experts are predicting. The average of those predictions is up 6.13%. Those waiting for the bubble to burst (this isn’t a bubble) are going to have to wait a while longer.

If you are thinking about selling your home anytime this year we should talk now and develop a plan for you. With super low inventory and high demand, the best time to sell is now! For buyers, we also need to strategize to get you the property you want. This seller’s market requires different tactics in order to get your offer accepted.

Individual Areas

Here are the January stats for the individual areas:

- Corolla – Sales are flat, median sales price up 12% to $812,500. Average days on market 48, compared to 106 in 2021.

- Duck – Sales up 42%, median sales price up 21% to $786,000. Average days on market 41 compared to 22 in 2021. But without the co-ownerships, where 5 plus weeks are sold, not the property itself, sales were up 27%, median sales price up 51% to $1,129,450. Average days on market 29 compared to 26 in 2021.

- Southern Shores – Sales up 25%, median sales price up 22% to $798,250. Average days on market 35 compared to 101 in 2021.

- Kitty Hawk – Sales are down 8%, median sales price down 12% to $442,000. Average days on market 20 compared to 26 in 2021.

- Colington – Sales down 37%, median sales price up 39% to $499,450. Average days on market 26 compared to 38 in 2021.

- Kill Devil Hills – Sales up 9%, median sales price up 1% to $415,000. Average days on market 39 compared to 41 in 2021.

- Nags Head – Sales down 36%, median sales price up 18% to $740,000. Average days on market 44 compared to 96 in 2021.

- All Hatteras – Sales down 15%, median sales price down 5% to $499,000. Average days on market 60 compared to 216 in 2021.

- Roanoke Island – Sales up 7%, median sales price up 9% to $465,750. Average days on market 46 compared to 81 in 2021.

- Currituck Mainland – Sales down 27%, median sales price up 1% to $335,000. Average days on market 20 compared to 38 in 2021.

- Ocracoke – Sales up 50%, median sales price up 53% to $662,000. Average days on market 156 compared to 7 in 2021.

Information in this article is based on information from the Outer Banks Association of REALTORS® MLS for the period January 1, 2013, through February 8th, 2022.

Mike is a long-time “Outer Banker”, both as a vacationer and a full-time resident. You may also know him as “Moose”, his nickname since he was 15 years old, and his on-air radio name for decades in Raleigh, Greensboro/Winston-Salem, Norfolk, and formerly on Beach 104 every morning on the “Moose & Jody Show” for over 14 years. Michael has built successful businesses on the Outer Banks. He is active in the community as well as a founding board member and Vice President of “Outer Banks Forever”, Past President of “The First Flight Society”, a founding member of “The Outer Banks Bicycle & Pedestrian Coalition”, and Past President and current member of “First Flight Rotary. Moose shares your love of the Outer Banks and understands the uniqueness of the area. Learn more at mooseobx.com